EUR/USD পেয়ারের 5-মিনিটের চার্টের বিশ্লেষণ

বৃহস্পতিবার EUR/USD কারেন্সি পেয়ারের মূল্যের সাইডওয়েজ মুভমেন্ট অব্যাহত ছিল। আগে এই পেয়ারের মূল্য 1.1274 থেকে 1.1391 রেঞ্জের মধ্যে মুভমেন্ট প্রদর্শন করছিল, কিন্তু বৃহস্পতিবার এই রেঞ্জের ঊর্ধ্বসীমার কাছাকাছি সম্পূর্ণ ফ্ল্যাট মুভমেন্ট পরিলক্ষিত হয়েছে। গত এক সপ্তাহ ধরে ইউরোর মূল্যের সাইডওয়েজ মুভমেন্ট দেখা যাচ্ছে, তবে ইউরোপীয় কেন্দ্রীয় ব্যাংকের বৈঠক চলাকালীন সময়ে বৃহস্পতিবার এই পেয়ারের মূল্যের স্বল্প মাত্রার অস্থিরতা দেখা যাচ্ছে এবং একেবারেই কোনো নির্দিষ্ট দিকে যাওয়ার প্রবণতা দেখা যায়নি। আমাদের মতে, এটি আবারও একটি স্পষ্ট সত্য তুলে ধরছে—বর্তমানে মার্কেটের ট্রেডাররা কেবলমাত্র "ট্রাম্পের সংবাদের" ভিত্তিতেই ট্রেড করছে। নতুন করে শুল্ক আরোপ করা হয়নি? বাণিজ্য যুদ্ধের উত্তেজনা কমে যাওয়া সংক্রান্ত কোনো খবর নেই? তাহলে মুভমেন্টও নেই।

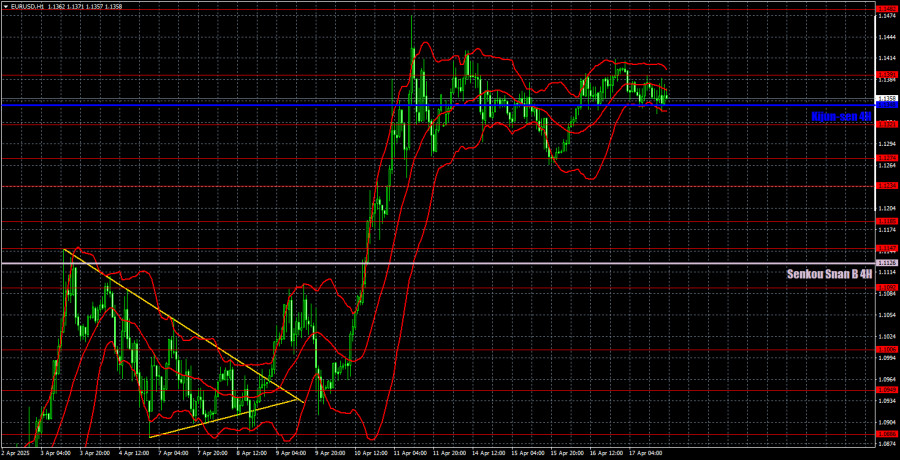

এই মুহূর্তে টেকনিক্যাল চার্ট সম্পর্কে কী বলা যায়? 1-ঘণ্টার টাইমফ্রেমে এই পেয়ারের মূল্যের ফ্ল্যাট মুভমেন্ট দেখা যাচ্ছে, যা খুব দ্রুতই আবার নতুন করে ডলার বিক্রির প্রবণতায় পরিণত হতে পারে, বিশেষত যদি ডোনাল্ড ট্রাম্প নতুন করে শুল্ক আরোপের ঘোষণা দেন। দুর্ভাগ্যবশত, ডলারসহ অনেক কারেন্সির ভাগ্য এখন এক ব্যক্তির হাতে। ট্রাম্প কখন নতুন করে শুল্ক আরোপ করবেন? কেউ জানে না। সেই শুল্কের মাত্রা কেমন হবে? তাও অজানা। তাই এই কারেন্সি পেয়ারের মূল্যের ভবিষ্যৎ মুভমেন্ট সম্পর্কে পূর্বাভাস দেওয়া একপ্রকার অর্থহীন। সর্বোচ্চ যা করা সম্ভব, তা হলো—শুধু তখনই ট্রেড করা, যদি শক্তিশালী ও নির্ভরযোগ্য টেকনিক্যাল সিগন্যাল পাওয়া যায়।

বৃহস্পতিবার তুলনামূলকভাবে শক্তিশালী ও নির্ভুল একটি সিগন্যাল গঠিত হয়েছিল—1.1391 লেভেল থেকে স্বল্প বিচ্যুতিতে রিবাউন্ড হয়েছিল। এরপর মূল্য প্রায় 35 পিপস পর্যন্ত কমে, যদিও এটি নিকটবর্তী টার্গেট লেভেল পর্যন্ত পৌঁছাতে ব্যর্থ হয়। অন্যদিকে, দিনের মধ্যে মূল্য 1.1391 লেভেল ব্রেকও করতে পারেনি। তাই যেকোনো সুবিধাজনক লেভেলে ম্যানুয়ালি শর্ট পজিশন ক্লোজ করতে হয়েছে।

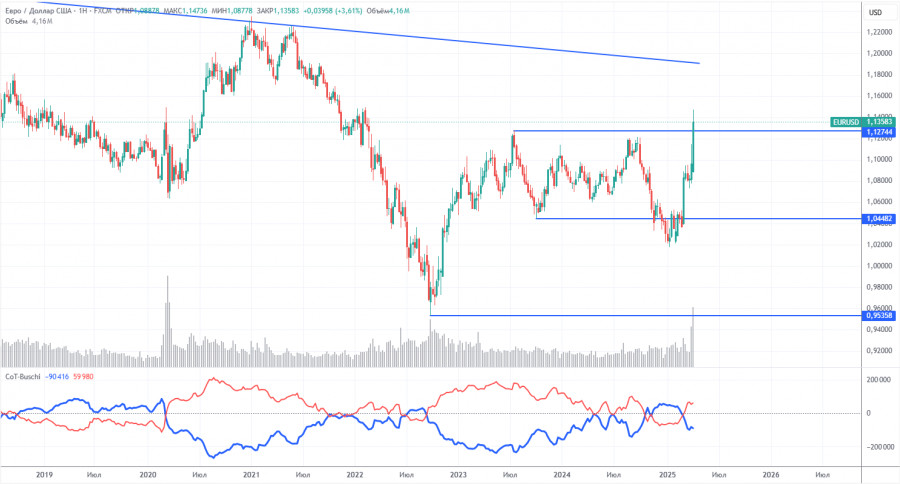

COT রিপোর্ট

সর্বশেষ COT রিপোর্টটি ৮ এপ্রিল প্রকাশিত হয়েছে। উপরের চার্টে দেখা যাচ্ছে, নন-কমার্শিয়াল ট্রেডারদের নিট পজিশন দীর্ঘ সময় ধরে বুলিশ টেরিটরিতে ছিল। বিক্রেতারা খুব অল্প সময়ের জন্য নিয়ন্ত্রণ নিতে পেরেছিল, তবে এখন ক্রেতারা আবারও নিয়ন্ত্রণ ফিরে পেয়েছে। ট্রাম্প প্রশাসন দায়িত্ব নেওয়ার পর থেকে মার্কেটে বিক্রেতাদের সুবিধা কমে এসেছে এবং ডলারের দরপতন শুরু হয়েছে।

আমরা নিশ্চিতভাবে বলতে পারি না যে ডলারের দরপতন চলতেই থাকবে কিনা, এবং বর্তমান পরিস্থিতিতে COT রিপোর্টগুলো বড় ট্রেডারদের সেন্টিমেন্ট তুলে ধরলেও তা খুব দ্রুত পরিবর্তিত হতে পারে।

আমরা এখনও ইউরোর শক্তিশালী হওয়ার জন্য কোনো মৌলিক ভিত্তি দেখতে পাচ্ছি না, তবে ডলারের দুর্বল হওয়ার পেছনে একটি বড় কারণ এখন সক্রিয় রয়েছে। আরও কয়েক সপ্তাহ বা মাসব্যাপী এই পেয়ারের মূল্যের কারেকশন হতে পারে, তবে ১৬ বছর ধরে চলমান নিম্নমুখী প্রবণতার একদিনে পরিবর্তন ঘটে না।

বর্তমানে লাল ও নীল লাইন আবারও একে অপরকে অতিক্রম করেছে, যা একটি বুলিশ প্রবণতার সংকেত। সর্বশেষ সাপ্তাহিক রিপোর্ট অনুযায়ী "নন-কমার্শিয়াল" গ্রুপের লং পজিশনের সংখ্যা 7,000 বৃদ্ধি পেয়েছে, এবং শর্ট পজিশন 1,100 হ্রাস পেয়েছে—ফলে মোট 8,100 কন্ট্রাক্ট বৃদ্ধি পেয়েছে।

EUR/USD পেয়ারের ১-ঘণ্টার চার্টের বিশ্লেষণ

যখন ট্রাম্প নতুন করে শুল্ক আরোপ করতে শুরু করেন তখন ঘন্টাভিত্তিক টাইমফ্রেমে দ্রুতই পুনরায় EUR/USD পেয়ারের মূল্যের ঊর্ধ্বমুখী মুভমেন্ট শুরু হয়। বর্তমানে মূল্য ফ্ল্যাট অবস্থায় রয়েছে, এবং আমরা নতুন করে শুল্ক আরোপের ঘোষণার জন্য অপেক্ষা করছি। দৈনিক টাইমফ্রেমে এখন আনুষ্ঠানিকভাবে বলা যায়, নিম্নমুখী প্রবণতা বাতিল হয়ে গেছে। ট্রাম্প যদি বাণিজ্যযুদ্ধ শুরু না করতেন, তাহলে এটি কখনোই ঘটত না। সুতরাং, এই ক্ষেত্রে মৌলিক প্রেক্ষাপট টেকনিক্যাল চিত্রকে ছাপিয়ে গেছে — এটি খুব বেশি ঘটে না, তবে মাঝেমধ্যে ঘটে। দুর্ভাগ্যবশত, এই ঊর্ধ্বমুখী প্রবণতা হঠাৎ করেই শেষ হয়ে যেতে পারে, বিশেষত যদি ট্রাম্প নতুন করে শুল্ক আরোপ বন্ধ করে দেন এবং উত্তেজনা প্রশমনের পথ বেছে নেন।

১৮ এপ্রিলে ট্রেডিংয়ের ক্ষেত্রে যেসব লেভেল বিবেচনায় রাখা উচিত: 1.0757, 1.0797, 1.0823, 1.0886, 1.0949, 1.1006, 1.1092, 1.1147, 1.1185, 1.1234, 1.1274, 1.1323, 1.1391, 1.1482, সেইসাথে সেনকৌ স্প্যান B লাইন (1.1126) এবং কিজুন-সেন লাইন (1.1348) রয়েছে। মনে রাখতে হবে, দিনের বেলা ইচিমোকু সূচকের লাইনগুলোর অবস্থান পরিবর্তিত হতে পারে, তাই ট্রেডিং সিগন্যাল নির্ধারণ করার সময় এই পরিবর্তন বিবেচনায় রাখা জরুরি। এছাড়াও, যদি মূল্য সঠিক দিকে ১৫ পিপস মুভমেন্ট প্রদর্শন করে, তাহলে ব্রেকইভেনে স্টপ লস অর্ডার সেট করতে ভুলবেন না — কারণ এটি ভুল সিগন্যালের ক্ষেত্রে লোকসান থেকে সুরক্ষিত থাকতে সহায়তা করে।

শুক্রবার ইউরোজোন বা যুক্তরাষ্ট্রে কোনো গুরুত্বপূর্ণ ইভেন্ট বা প্রতিবেদন প্রকাশের কথা নেই। তবে বৃহস্পতিবারের ঘটনা প্রমাণ করেছে যে এখন আর বড় কোনো ইভেন্টও মার্কেটে মুভমেন্ট বা প্রতিক্রিয়া নিশ্চিত করতে পারে না। বর্তমানে মার্কেট কেবল বাণিজ্যযুদ্ধ সংক্রান্ত সংবাদের ভিত্তিতেই চালিত হচ্ছে।

চিত্রের ব্যাখা:

- সাপোর্ট ও রেজিস্ট্যান্স লেভেল (গাঢ় লাল লাইন): এই লাইনগুলো নির্দেশ করে কোথায় মার্কেট মুভমেন্ট শেষ হতে পারে। তবে, এই লাইনগুলো ট্রেডিং সিগন্যালের উৎস নয়।

- কিজুন-সেন এবং সেনকৌ স্প্যান B লাইন: ইচিমোকু সূচকের লাইনগুলো ৪-ঘণ্টার টাইমফ্রেম থেকে ১-ঘণ্টার টাইমফ্রেমে স্থানান্তরিত হয়েছে। এগুলো গুরুত্বপূর্ণ লাইন।

- এক্সট্রিম লেভেল (হালকা লাল লাইন): এগুলো হচ্ছে সেসব লেভেল যেখান থেকে পূর্বে মূল্যের বাউন্স হয়েছিল। এগুলো ট্রেডিং সিগন্যালের উৎস হিসেবে কাজ করতে পারে।

- হলুদ লাইন: ট্রেন্ডলাইন, ট্রেন্ড চ্যানেল বা যেকোনো টেকনিক্যাল প্যাটার্ন নির্দেশ করে।

- COT চার্টের ইনডিকেটর 1: প্রতিটি ক্যাটাগরির ট্রেডারদের নিট পজিশন সাইজ নির্দেশ করে।