The US dollar remains stable, and investors are avoiding major transactions ahead of the Federal Reserve meeting. It is scheduled for October 31. It will end on Wednesday with the publication of the key rate decision.

After that, a press conference will start, during which the Federal Reserve Chair will explain the bank's decision and may talk about the state of the US economy and future monetary policy. Any unexpected statements from Powell on this topic will lead to increased volatility in the dollar's exchange rates and in the US stock market.

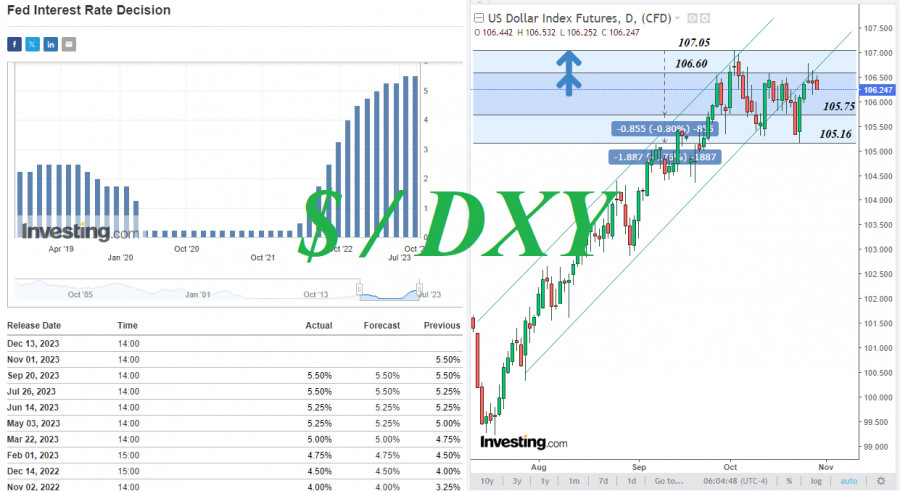

The interest rate is likely to remain at the current level, but there is also a possibility of a 0.25% increase to 5.75%. Investors want to hear Powell's opinion on the Federal Reserve's plans for this and next year.

The dollar is also in demand as a safe-haven asset amidst the current global geopolitical situation.

The macroeconomic data presented last week in the United States confirmed the strength of the US economy. In this light, buyers of the US dollar expect tough rhetoric from Powell, considering that inflation in the country remains well above the Federal Reserve's 2% target.

According to the published data, US GDP advanced by 4.9% in the third quarter (compared to a previous quarterly growth of 2.1% and a forecast of 4.2%). This is the highest growth rate since the end of 2021. The price index, which reflects changes in prices for goods and services and is used as an inflation indicator, increased to 3.5% in the third quarter (compared to a previous increase of 1.7% and a forecast of 2.5%), indirectly signaling an acceleration in inflation.

The PMI indices published earlier last week also exceeded forecasts. For example, the preliminary data showed that manufacturing PMI increased to 50.0 points in October (compared to a forecast of 49.5 points and the previous 49.8 points), and the services PMI increased to 50.9 points from 50.1 points in September, also surpassing the forecast of 49.9 points. Furthermore, the US Composite PMI is above the 50-point level, indicating growth in business activity rather than a slowdown.

However, some economists believe the Federal Reserve may opt for a cut in the interest rate instead of raising it further. Judging by the fact that the dollar index stopped its rise, such a forecast also has grounds, indicating that some investors prefer to close part of their numerous long positions in the dollar.

In other words, the results of this Federal Reserve meeting and the accompanying statements can significantly determine the direction of the dollar's future dynamics. However, this almost always happens after any Federal Reserve meeting.

In the dynamics of the DXY dollar index, two ranges can be highlighted: a wide one between 107.05 and 105.16, and a narrow one between 106.60 and 105.75. According to the main scenario, we expect a consistent breakthrough of resistance levels at 106.60 and 107.05 and further growth in the DXY.

If Powell fails to convince dollar buyers and investors consider his comments not hawkish enough, the dollar may experience a downward correction. Many economists still believe that the dollar is significantly overbought. The first signal for closing long positions and opening short ones would be a break below support levels at 106.00 and 105.75.

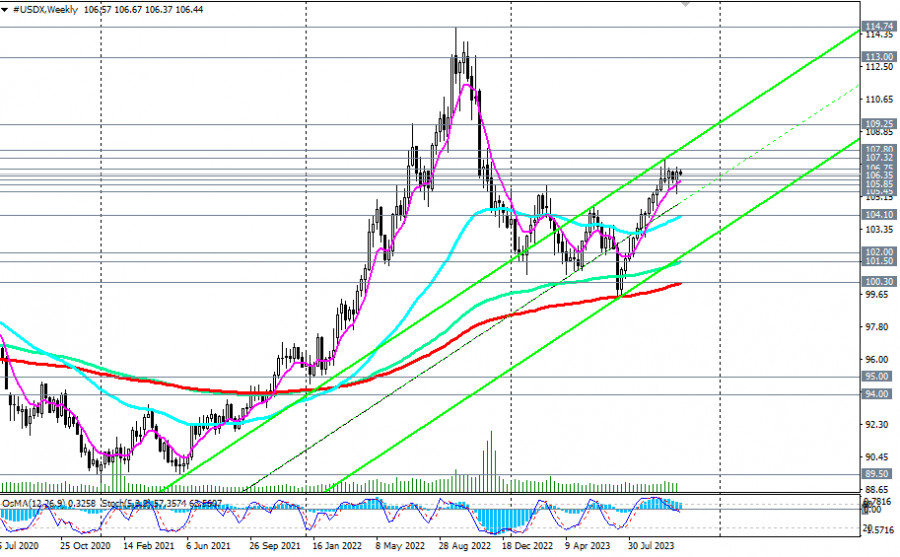

From a technical point of view, the dollar index remains within a stable bullish market zone, with the medium-term level above the key level of 104.10 (EMA200 on the daily chart) and the long-term level above key support levels at 101.50 (EMA144 on the weekly chart), 100.30 (EMA200 on the weekly chart), and 100.00.

Long positions are currently preferred. The nearest growth targets will be local resistance levels at 107.00, 107.32, 107.80, and 108.00.

However, as mentioned earlier, if Powell fails to convince traders, the US dollar may slump to the important medium-term support level at 105.45 (EMA50 on the daily chart). Further changes will depend on market conditions.

Support levels: 106.35, 106.10, 106.00, 105.85, 105.45, 105.00, 104.10, 103.00, 102.00, 101.50, 101.00, 100.30, 100.00

Resistance levels: 106.75, 107.00, 107.32, 107.80, 108.00, 109.00, 109.25