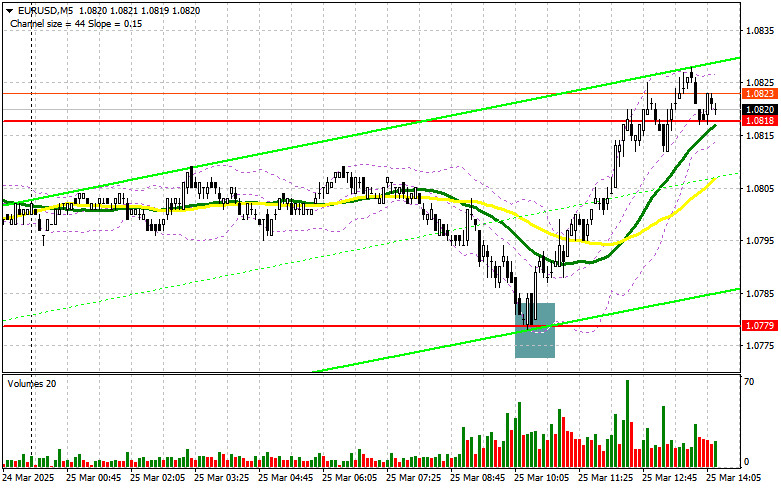

In my morning forecast, I highlighted the 1.0779 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and examine what happened there. The decline and formation of a false breakout at that level provided a good entry point, resulting in a rise of over 40 points. The technical picture has not changed for the second half of the day.

To open long positions on EURUSD:

Clearly, decent IFO data from Germany helped revive demand for the euro and halted the downward correction in the EUR/USD pair. However, everything could change in the second half of the day as we await important U.S. data. Strong figures for consumer confidence and new home sales in the U.S. will likely support the dollar, leading to a decline in the pair. Otherwise, EUR/USD could continue rising. If the data is ignored, focus will shift to the speech by FOMC member John Williams.

In the event of a decline, only a false breakout around the 1.0780 support area would signal new EUR/USD purchases in anticipation of building a bullish market with a target of retesting 1.0818, which is where the pair is trading now. A breakout and retest of this range will confirm a proper buy entry with a target of 1.0856. The furthest target will be 1.0892, where I plan to take profit.

If EUR/USD declines and shows no activity around 1.0780—which is more likely—the pair may continue correcting. In this case, sellers could drag it down to 1.0746. Only after a false breakout there will I consider buying the euro. I plan to open long positions from 1.0715 on a rebound, targeting a 30–35 point intraday correction.

To open short positions on EURUSD:

Sellers showed up around 1.0818, but a full-fledged move down hasn't occurred yet. If we don't see any reaction after the data release either, it's better to delay short positions until a test of 1.0856. Only a false breakout there will allow entry into short positions targeting a correction to 1.0818, where the moving averages are also located. A breakout and consolidation below this area would offer another valid selling opportunity with a move toward 1.0780. The furthest target will be 1.0746, where I plan to take profit.

If EUR/USD rises in the second half of the day and sellers fail to act around 1.0856, buyers may push the pair higher. In that case, I'll postpone short positions until a test of the next resistance at 1.0892. I will sell from there only after a failed consolidation. If there's no downward movement from that level either, I'll consider short positions from 1.0923 on a rebound, targeting a 30–35 point downward correction.

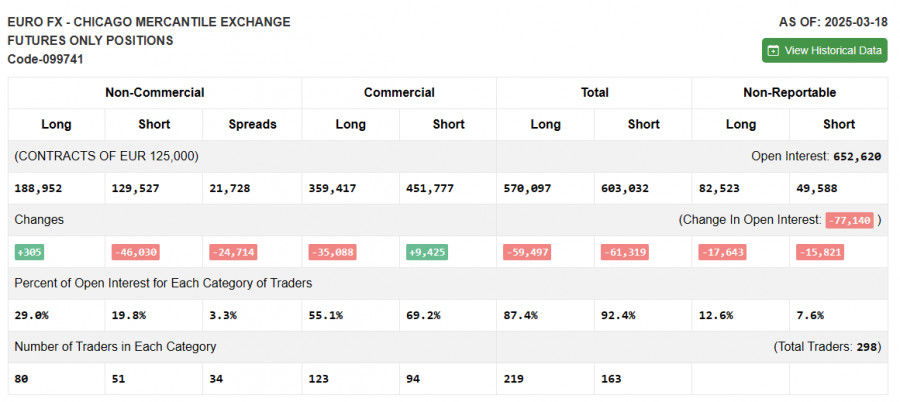

COT Report (Commitment of Traders) as of March 18:

The report showed an increase in long positions and a significant reduction in shorts. More and more traders are willing to buy the euro, while sellers are continuing to exit the market. The ECB's cautious approach to cutting interest rates and weak U.S. data, which is forcing the Federal Reserve to adopt a more dovish stance, are reasons behind a major shift in market dynamics.

The COT report indicates that non-commercial long positions rose by 305 to 188,952, while short positions dropped by 46,030 to 129,527. As a result, the net gap between long and short positions decreased by 24,714.

Indicator Signals:

Moving Averages: Trading is occurring around the 30- and 50-day moving averages, indicating a sideways market.

Note: The periods and prices of moving averages are considered on the H1 hourly chart by the author and may differ from the standard definitions on the D1 daily chart.

Bollinger Bands: In case of a decline, the lower band of the indicator near 1.0780 will act as support.

Indicator Descriptions:

- Moving Average (MA): Identifies the current trend by smoothing volatility and noise. Period – 50 (yellow on the chart); Period – 30 (green on the chart).

- MACD (Moving Average Convergence/Divergence): Fast EMA – period 12; Slow EMA – period 26; Signal SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Non-commercial long positions: The total open long positions held by non-commercial traders.

- Non-commercial short positions: The total open short positions held by non-commercial traders.

- Net non-commercial position: The difference between short and long non-commercial positions.