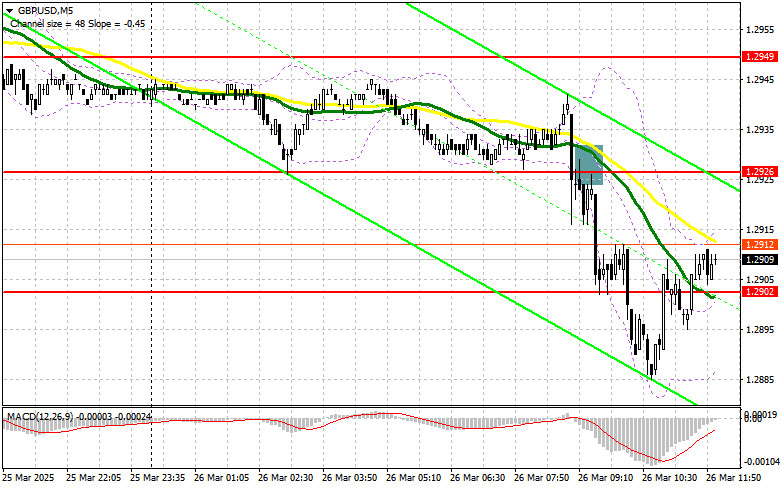

In my morning forecast, I highlighted the 1.2926 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. The breakout and retest of 1.2946 provided an entry point for selling the pound, which—together with news of declining U.S. inflation—triggered a large sell-off in the pair. The technical outlook for the second half of the day has been revised.

To open long positions on GBP/USD:

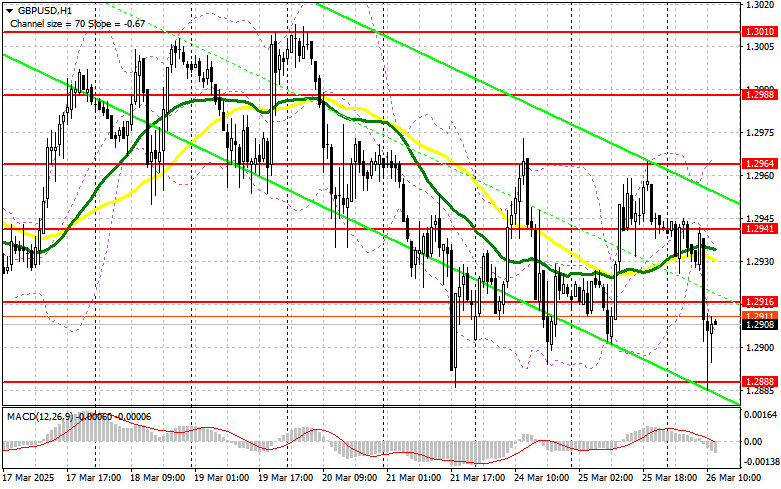

The U.K. recorded a slowdown in inflation, which triggered a sharp drop in the pound. Statistical reports indicated a weakening in consumer price growth, fueling speculation about potential monetary easing from the Bank of England. Against this backdrop, traders rushed to sell the pound, causing the pair to plunge.

In the second half of the day, we expect U.S. data on Durable Goods Orders and speeches by FOMC members Neel Kashkari and Alberto Musalem. If market reaction to the data and remarks is bearish, only a false breakout at the 1.2886 level will provide a good entry point for long positions with a target of recovering to resistance at 1.2916. A breakout and retest of this range from above will offer another entry signal for long positions, with the prospect of reaching 1.2941. The ultimate target will be the area of 1.2964, where I plan to take profit.

If GBP/USD declines and buyers show no activity at 1.2886 in the second half of the day, pressure on the pound may return, trapping the pair within a sideways channel. In that case, a false breakout at 1.2861 will be a suitable condition for initiating long positions. I also plan to buy GBP/USD on a rebound from the 1.2835 support level for a 30–35 point intraday correction.

To open short positions on GBP/USD:

The pound collapsed after the data release, and now bears need to defend the nearest resistance at 1.2916 to sustain the downtrend. If the reaction to reports is bullish, only a false breakout at 1.2916 will offer an entry point for selling, targeting new support at 1.2886, which formed during the first half of the day. A breakout and retest of this range from below will trigger stop-losses and open the path toward 1.2861, marking a significant correction. The final target will be the 1.2835 area, where I plan to take profit. Testing this level could stall the bullish recovery.

If demand for the pound returns in the second half of the day and bears fail to assert themselves at 1.2916, it's better to delay selling until a test of the 1.2941 resistance level. This level lies just below the moving averages, which currently favor sellers. I will only open short positions there after a failed breakout. If there is no downward movement at that level either, I will look for a short-term rebound entry at 1.2964, targeting a 30–35 point intraday pullback.

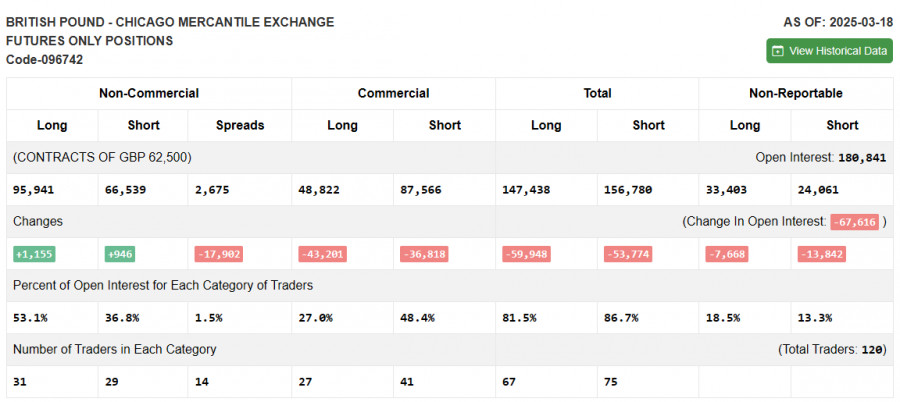

COT Report (Commitment of Traders) – March 18:

The report showed an increase in both long and short positions, but the growth in long positions was significantly larger, giving buyers a notable advantage. This is confirmed by the GBP/USD chart. Following the Bank of England's meeting, it became clear that the regulator is taking a more gradual approach to rate cuts—and may even adopt a more hawkish stance going forward. Many are concerned about Trump's tariff policies, which could spark an inflation spike that the U.K. is already struggling to control. The current stance of the Bank of England supports pound buyers and will likely continue to do so.

The latest COT report indicated that long non-commercial positions increased by 1,155 to 95,941, while short non-commercial positions grew by only 946 to 66,539. As a result, the gap between long and short positions narrowed by 17,902.

Indicator Signals:

Moving Averages Trading is occurring below the 30- and 50-day moving averages, indicating further downside potential for the pair.

Note: The author uses the H1 (hourly) chart for moving average periods and prices, which may differ from the standard D1 (daily) chart settings.

Bollinger Bands In case of a decline, the lower boundary of the indicator around 1.2906 will serve as support.

Indicator Descriptions:

- Moving average (MA): Smooths out volatility and noise to identify the current trend.

- Period 50 – marked in yellow

- Period 30 – marked in green

- MACD (Moving Average Convergence/Divergence):

- Fast EMA: 12

- Slow EMA: 26

- Signal Line SMA: 9

- Bollinger Bands: Period – 20

- Non-commercial traders: Speculators such as retail traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Long non-commercial positions: Total long open interest held by non-commercial traders.

- Short non-commercial positions: Total short open interest held by non-commercial traders.

- Net non-commercial position: The difference between short and long positions held by non-commercial traders.