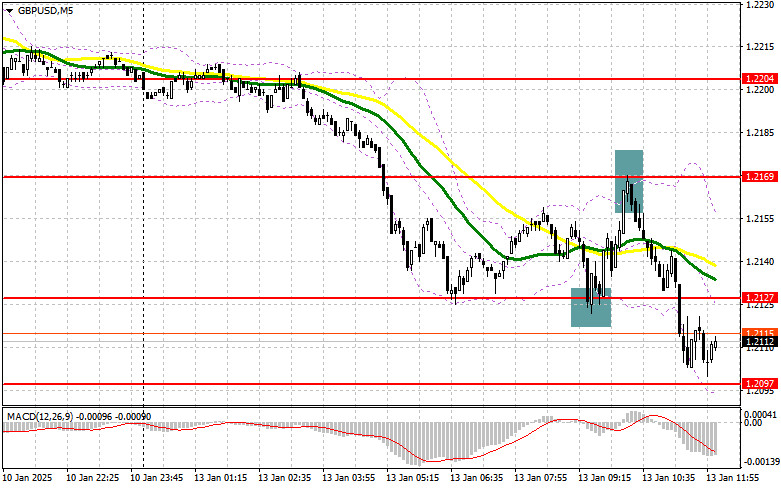

In my morning forecast, I highlighted the level of 1.2127 and planned to make trading decisions based on it. Let's examine the 5-minute chart and analyze what happened. A decline followed by the formation of a false breakout at that level provided a strong entry point for buying the pound, resulting in a correction of over 40 pips. Active resistance at 1.2169 allowed for entry into short positions along the trend, securing more than 50 points of profit.

To Open Long Positions on GBP/USD:

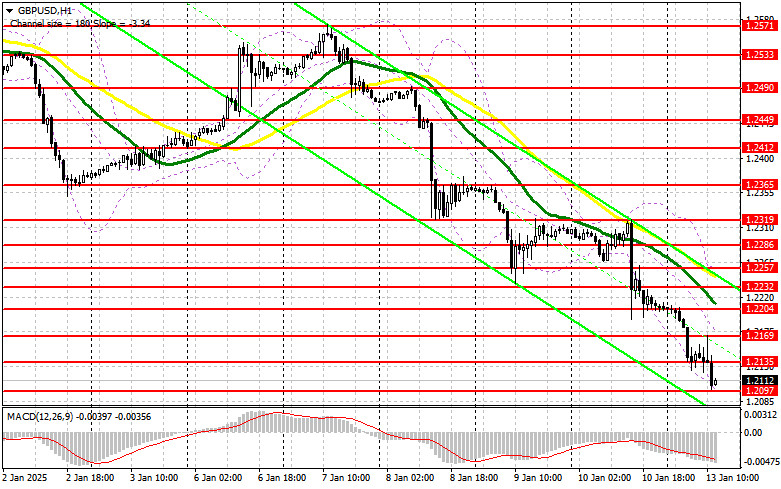

The active efforts by pound sellers are a reminder of the challenges the UK economy faces and will continue to face in the near future. Today, there is no significant US economic data, and the monthly US Treasury budget report is unlikely to attract traders' attention. This provides an opportunity for another attempt at a pair correction during the US session, which could draw new sellers into the market.

I plan to buy only after a false breakout forms around the support level of 1.2097, which narrowly missed being tested earlier today. The goal will be to restore GBP/USD to the resistance level of 1.2135. A breakout and retest of this range from above would provide a new entry point for long positions, with the prospect of retesting 1.2169, a level from which the pair has already declined sharply today. Buyers are likely to face more serious challenges there. The ultimate target will be the 1.2204 level, where I plan to take profits.

If GBP/USD declines further and bulls fail to show activity around 1.2097, the pound could fall even lower. In this case, only a false breakout around the next support level of 1.2065 would create a suitable condition for opening long positions. I will open long positions on a direct rebound from the 1.2038 low, aiming for a 30–35 point correction during the day.

To Open Short Positions on GBP/USD:

Pound sellers remain in control of the market. If the pair recovers, defending the resistance at 1.2135 will be a priority for bears. A false breakout at this level would create a strong entry point for short positions, targeting a decline to 1.2097. A breakout and retest of this range from below would trigger stop orders, opening the path to 1.2065, a new monthly low, signaling the strengthening of the bearish market. The ultimate target will be the 1.2038 level, where I plan to take profits.

If demand for the pound returns in the second half of the day and bears fail to show activity around 1.2135, it's better to postpone selling until the resistance at 1.2168 is tested. I will open short positions there only after a failed consolidation, as described earlier. If there is no downward movement even at that level, I will look for short positions on a rebound around 1.2204, aiming for a 30–35 point correction during the day.

Commitments of Traders (COT) Report:

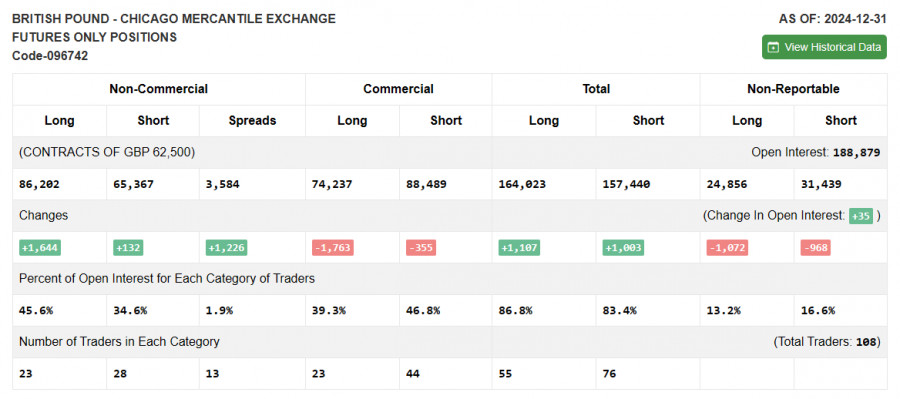

The COT report for December 31 showed growth in both long and short positions. Overall, the balance of forces remained unchanged, as many traders took a wait-and-see approach at the end of the year following the Bank of England's final meeting. The regulator's future stance raises many questions, so attention is likely to shift toward Donald Trump's inauguration and its implications for UK interest rates. If Trump's stance is more lenient and doesn't involve restrictive tariffs on the UK, the pound is likely to regain its positions, steering toward strengthening. Otherwise, a strong rise in the GBP/USD pair in the near future is unlikely. The latest COT report indicated that long non-commercial positions increased by 1,644 to 86,202, while short non-commercial positions rose by 132 to 65,367. As a result, the gap between long and short positions grew by 1,226.

Indicator Signals:

Moving Averages:

Trading occurs below the 30- and 50-day moving averages, indicating further declines in the pair.

Note: The author considers moving averages on the H1 chart, which may differ from the classic D1 definition.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator near 1.2123 will act as support.

Indicator Descriptions:

- Moving Average: Determines the current trend by smoothing volatility and noise. Period: 50 (yellow line), 30 (green line).

- MACD: Moving Average Convergence/Divergence. Fast EMA: 12, Slow EMA: 26, SMA: 9.

- Bollinger Bands: Period: 20.

- Non-commercial Traders: Speculators such as individual traders, hedge funds, and institutions using futures markets for speculative purposes.

- Long Non-commercial Positions: Represents the total long open positions of non-commercial traders.

- Short Non-commercial Positions: Represents the total short open positions of non-commercial traders.

- Net Non-commercial Position: The difference between short and long positions held by non-commercial traders.