Success history of the team headed by Ales Loprais can become your success history! Trade confidently and head towards leadership like regular participant of Dakar Rally and winner of Silk Way Rally InstaForex Loprais Team does it!

Join in and win with InstaForex!

16.01.2025 09:31 AM

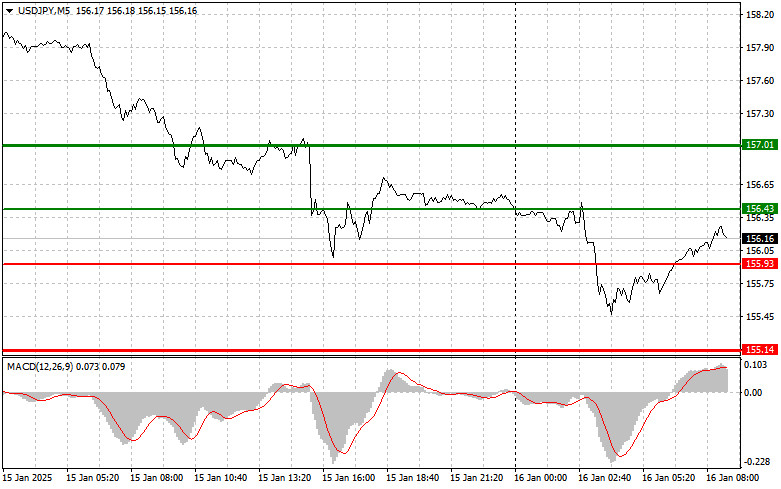

16.01.2025 09:31 AMThe test of the 156.63 level occurred when the MACD indicator had just begun to move downward from the zero level, confirming a valid entry point to sell the dollar. As a result, the pair decreased by approximately 60 pips.

Today's Producer Price Index (PPI) data from Japan prompted further buying of the yen against the dollar. Inflation rose by 0.3% month-over-month, while the annual growth reached an impressive 3.8%. The increase in producer prices is a critical signal for financial markets, leading to active investor responses. Rising inflation indicates sustained price pressures, which could potentially influence the country's monetary policy.

This current data reinforces expectations for possible monetary tightening by the Bank of Japan. Surveys suggest that the BOJ may raise rates at the upcoming meeting on January 24, with a potential increase of 0.5% by the end of March. However, the market remains vigilant regarding external economic factors, such as global inflation trends and policy changes by other central banks. Ensuring economic growth in Japan will be vital for the yen's continued strengthening and for the stability of financial markets.

Today, I will primarily focus on implementing Scenario #1 and Scenario #2.

Scenario #1: Buy USD/JPY upon reaching the 156.43 level (green line on the chart) with a target of 157.01 (thicker green line). At 157.01, I plan to exit the long position and open a short position in the opposite direction, aiming for a 30-35 pip correction. Be cautious with longs, as downward pressure on the pair may return anytime. Important: Before buying, ensure that the MACD indicator is above the zero level and starting to rise.

Scenario #2: Buy USD/JPY if there are two consecutive tests of the 155.93 level while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to an upward market reversal. The expected targets are the 156.43 and 157.01 levels.

Scenario #1: Sell USD/JPY after breaking below the 155.93 level (red line on the chart), which is expected to trigger a sharp decline in the pair. The key target for sellers will be 155.14, where I plan to exit the short position and open a long position in the opposite direction, targeting a 20-25 pip correction. Downward pressure on the pair is expected to persist today. Important: Before selling, ensure that the MACD indicator is below the zero level and starting to decline.

Scenario #2: Sell USD/JPY if there are two consecutive tests of the 156.43 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. The expected targets are the 155.93 and 155.14 levels.

You have already liked this post today

*Disclaimer: The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have any content questions, please contact editorial-board@instaforex.com

If you have any content questions, please contact editorial-board@instaforex.com

The 155.55 level test coincided with the moment when the MACD indicator had just started to move upward from the zero mark, confirming a correct entry point for buying

The first test of the 1.2420 price level coincided with the MACD indicator moving significantly below the zero mark, which limited the pair's downward potential. For this reason, I refrained

The first test of the 1.0421 price level occurred when the MACD indicator had already moved significantly below the zero mark, limiting the pair's downward potential. For this reason

The 155.42 price test occurred at a time when the MACD indicator had moved significantly below the zero mark, which, in my opinion, limited the pair's downward potential. For this

The test of the 154.35 price level coincided with the MACD indicator beginning to rise from the zero mark, confirming an optimal entry point for buying the dollar

The test of the 1.2490 price level in the second half of the day aligned with the MACD indicator beginning its downward movement from the zero mark. This provided

During the second half of the day, the price level of 1.531 was tested, coinciding with the MACD indicator remaining in the overbought zone for an extended period before beginning

The test of the 155.69 price level coincided with the MACD indicator moving significantly below the zero mark, which, in my view, limited the pair's downward potential. For this reason

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaForex anyway.

We are sorry for any inconvenience caused by this message.