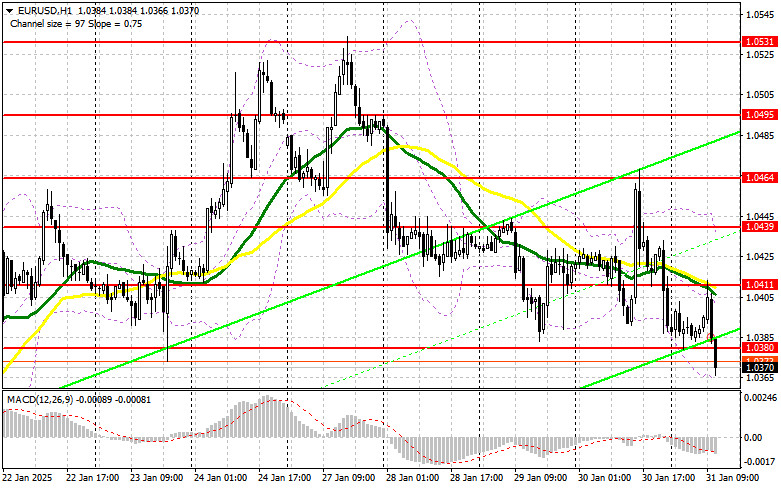

In my morning forecast, I highlighted the 1.0377 level as a key reference point for making entry decisions. Let's analyze the 5-minute chart to see what happened. While the price did decline, low volatility prevented the formation of suitable entry points, so I ended up staying out of the market. Given the lack of significant movements, I have revised the technical outlook for the second half of the day.

Trading Plan for Long Positions on EUR/USD

Weak data on Germany's retail sales and other Eurozone figures, combined with Trump's statement about introducing tariffs as early as tomorrow, maintained pressure on the euro. The pair broke below its weekly low, continuing its downward correction against the U.S. dollar.

This afternoon, we are set to receive more notable U.S. economic data, including Core PCE Price Index, Personal Income & Spending reports and speech from FOMC member Michelle Bowman.

If these reports show strong results, EUR/USD is likely to continue declining. For this reason, I am not rushing into buying the euro.

A false breakout at 1.0343 would be the only valid buying signal, targeting resistance at 1.0380, which was formed during the first half of the day. A break and retest of the 1.0380 level could confirm a buying opportunity, with an upside target at 1.0411, which would invalidate sellers' plans for a deeper correction. The final bullish target is 1.0439, where I will take profit.

If EUR/USD breaks below 1.0343 and there is no buyer activity, the pair risks dropping further, negating bullish prospects for the near term. In this case, sellers may push the pair toward 1.0311. Only after a false breakout at 1.0311 will I consider buying the euro. I will also look at buying from 1.0268 on a direct rebound, targeting an intraday correction of 30–35 points.

Trading Plan for Short Positions on EUR/USD

Sellers did not hesitate to push the euro lower, continuing the bearish momentum. If U.S. data disappoints, the focus will shift to defending the interim resistance at 1.0380—though I am not strongly confident in this level.

A false breakout at 1.0380 would confirm strong selling pressure, providing a shorting opportunity toward support at 1.0343. A break below 1.0343, followed by a retest from below, would confirm a short trade, targeting 1.0311 as the next downside level. The final bearish target is 1.0268, where I will lock in profits.

If EUR/USD moves higher in the afternoon and sellers fail to show activity at 1.0380, I will wait for a test of 1.0411, where the moving averages (favoring the bears) are also located. I will sell from 1.0411 but only after a failed breakout at this level. Alternatively, I will consider selling from 1.0439 on a direct rebound, targeting a downward correction of 30–35 points.

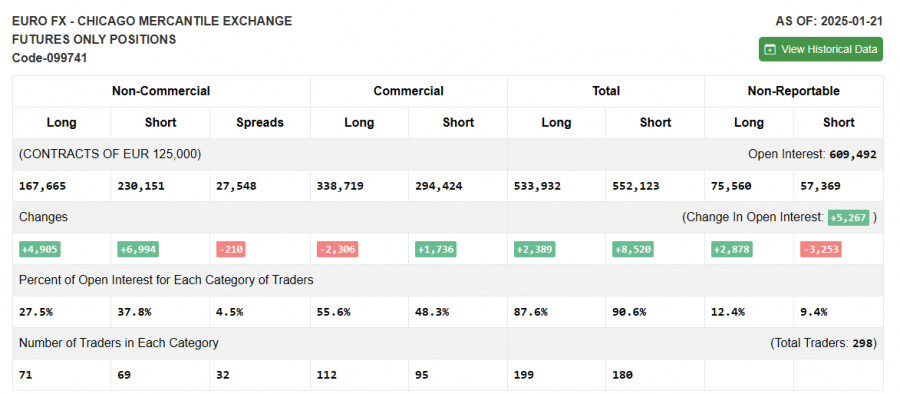

Commitments of Traders (COT) Report:

The COT report (Commitment of Traders) from January 21 showed an increase in both long and short positions, but this did not alter market sentiment.

Traders continue to favor short positions on the euro, as Trump is expected to shift from rhetoric to action—potentially driving the dollar higher against the euro. The future course of Federal Reserve policy remains uncertain, with further clarity expected soon, which could also strengthen the dollar. Non-commercial long positions increased by 4,905 to 167,665. Non-commercial short positions increased by 6,994 to 230,151. As a result, the gap between long and short positions narrowed by 210 contracts, reinforcing bearish sentiment in the market.

Indicator Signals

Moving Averages

Trading is occurring below the 30- and 50-day moving averages, maintaining pressure on the euro.

Note: The author evaluates moving averages on the hourly (H1) chart, which differs from traditional daily (D1) moving average definitions.

Bollinger Bands

If EUR/USD declines further, the lower Bollinger Band at 1.0365 will act as support.

Indicator Descriptions

- Moving Average (MA): Identifies the current trend by smoothing volatility and market noise.

- 50-period MA (yellow on chart)

- 30-period MA (green on chart)

- MACD (Moving Average Convergence/Divergence):

- Fast EMA: 12-period

- Slow EMA: 26-period

- Signal Line SMA: 9-period

- Bollinger Bands: 20-period

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions, who use the futures market for speculation and meet specific CFTC requirements.

- Non-commercial long positions: Total long contracts held by speculative traders.

- Non-commercial short positions: Total short contracts held by speculative traders.

- Net non-commercial position: The difference between short and long positions held by speculative traders.