This morning, the Japanese yen saw a significant increase against the U.S. dollar, approaching the crucial level of 153.00. Let's analyze the factors driving the yen's rally and consider how long this surge might continue.

Hawkish Market Sentiment

The yen rose more than 1% against the dollar today, reaching its highest level in over a month at 153.09.

This surge was fueled by unexpected strong wage data from Japan, which bolstered market expectations for further monetary tightening by the Bank of Japan (BOJ).

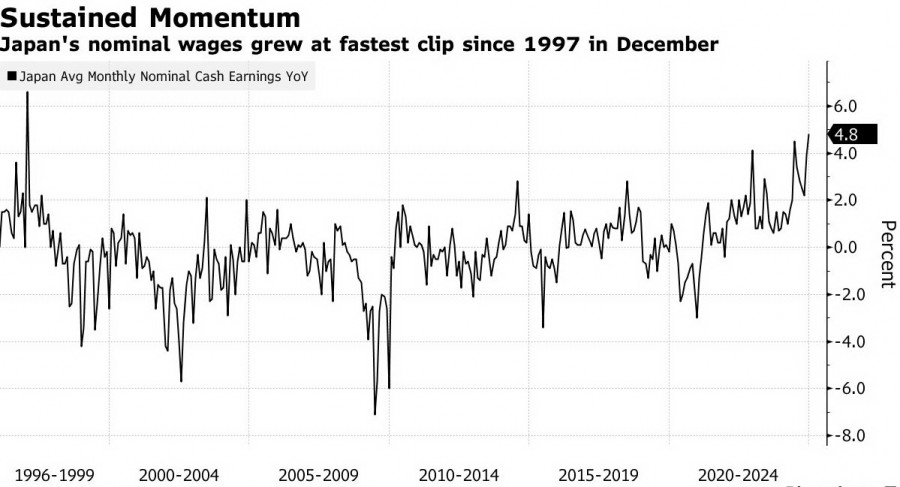

Data released on Wednesday morning revealed that nominal wages in Japan increased at the fastest pace in nearly 30 years in December, showing an annual growth of 4.8%, significantly higher than the forecasted 3.9%.

This significant jump was mainly due to a nearly 7% increase in special payments to workers, primarily from winter bonuses. It marked the fastest growth since 2001.

At the same time, real wages, adjusted for inflation and serving as a barometer of consumer purchasing power, rose 0.6% year-on-year last month, with November's figure revised upward to 0.5% from a 0.3% decline.

The government expressed optimism that wage growth would continue to accelerate this year, increasing the chances of additional BOJ policy tightening.

Wage trends remain a key focus for the market even after the BOJ's recent decision to raise borrowing costs, as they influence the timing of future rate hikes.

Last month, the BOJ raised interest rates for the third time in less than a year, citing positive wage dynamics as a key reason.

The yen's upward momentum was supported by record wage increases in 2024, as Japanese companies agreed to raise employee pay by an average of 5.1%.

Japan's largest labor union, Rengo, is advocating for a minimum wage increase of 5% in 2025, with a target of 6% for smaller firms to help reduce the income disparity with larger corporations.

Negotiations with companies are set to conclude in March, but positive updates are already surfacing: many businesses, including large corporations, have committed to raising wages by more than 7% for certain workers.

"Wage dynamics will undoubtedly remain a key factor in the BOJ's policy decisions. If the current trend continues, the central bank will likely implement another rate hike this year," said analyst Masato Koike.

His colleague Taro Kimura also believes that strong wage data should bolster the BOJ's confidence that wage growth aligns with the 2% inflation target, potentially leading to at least one more tightening round in 2025.

According to a Bloomberg survey published last week, most observers of the BOJ expect another rate hike in about six months, with July being the most likely month for this increase.

Following the release of today's wage data, investors raised the probability of a rate hike at the BOJ's June meeting to 78%.

This expectation was further bolstered by recent comments from former BOJ chief economist Hideo Hayakawa, who stated to Bloomberg on Tuesday that the central bank will likely continue raising rates beyond current market expectations.

Based on his assessment, Hayakawa predicted the BOJ's terminal rate in this tightening cycle would reach around 1.5%. This is higher than most analysts' forecasts, though it aligns with the International Monetary Fund's projection.

"My core view is that there is still much to be done," the former BOJ official noted. "There is little logical basis to assume rate hikes will stop anytime soon."

Additional Factors Driving the Yen

In addition to expectations of hawkish BOJ moves, the yen is also gaining support from various factors. For instance, last night, investors turned to safe-haven assets amid a renewed escalation in U.S.-China relations.

On February 4, the White House delayed tariffs on Canada and Mexico after both countries agreed to strengthen their borders with the U.S. to curb illegal migration and drug trafficking.

However, Washington took a hardline stance on China, imposing 10% tariffs on Chinese goods as previously promised.

In response, Beijing immediately announced reciprocal tariffs on U.S. imports, further escalating tensions in global markets.

U.S. President Donald Trump, instead of seeking ways to de-escalate the conflict, stated that he had no intention of speaking with Chinese President Xi Jinping in the near future.

These developments heightened investor fears of further deterioration in trade relations between the world's two largest economies. The primary concern is the potential disruption of supply chains, which could slow global growth and increase recession risks.

In this context, the demand for the Japanese currency has risen sharply, particularly as the BOJ is set to tighten monetary policy further.

While the dollar is also considered a safe-haven asset, its position appears less stable at the moment. Investors are beginning to doubt whether the Federal Reserve will refrain from cutting rates in the near future, despite statements from its officials.

For example, Fed Vice Chair Philip Jefferson said on Tuesday that there was no need to rush into rate cuts, given the strength of the U.S. economy and the need for a cautious approach.

However, recent macroeconomic data indicates that the Fed might have grounds to ease its monetary policy. According to the U.S. Bureau of Labor Statistics (BLS), the number of job vacancies in the country dropped to 7.6 million in December, down from 8.09 million in November and below the expected 8 million.

This data signals a slowdown in labor market growth, which could lead to a monetary policy shift by the Fed and further weaken the dollar.

Market attention is now focused on Friday's Nonfarm Payrolls report for January, which will serve as a key indicator for assessing the U.S. labor market and the Fed's next steps.

If the data confirms a cooling labor market in the U.S., it could heighten expectations of rate cuts in the coming months.

In that case, pressure on the dollar would increase, while the yen could continue to strengthen amid the growing divergence in the monetary policies of the Fed and the BOJ.

Investors will carefully examine the new jobs indicator, the unemployment rate, and wage growth dynamics, which could provide the Fed with further reasons to ease monetary policy.

What Do the Charts Say?

From a technical perspective, a break and consolidation below the 154.00 level could serve as a new bearish signal, increasing pressure on the USD/JPY pair.

Oscillators on the daily chart continue to show negative dynamics, remaining far from the oversold zone. This suggests that the potential for further declines remains high, with the path of least resistance still pointing downward.

In this scenario, the next target for sellers could be the 153.00 level, followed by the 152.45 area, where the 100-day moving average lies. If the bears manage to consolidate below this level, the pair risks extending its downward trajectory.

On the other hand, if USD/JPY breaks above the 154.00 level, the pair may test 154.70–154.75, and then rise toward the psychologically important 155.00 mark.

However, stronger upward movement will likely attract new sellers, limiting gains near the 155.25–155.30 zone. Only a decisive breakout above these levels could shift market sentiment towards a bullish scenario and reverse the downtrend.