Analysis of Monday's Trades

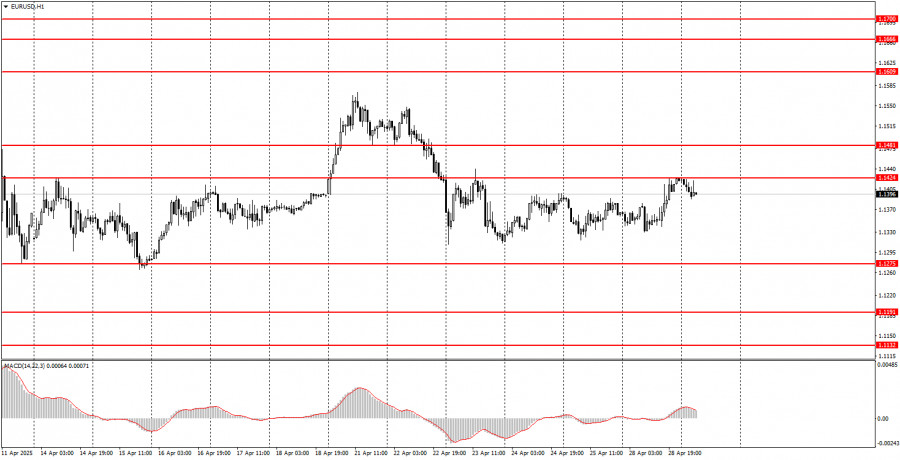

1H Chart of EUR/USD

On Monday, the EUR/USD currency pair showed somewhat mixed movements, no matter how you look. On the one hand, the pair demonstrated a strong upward move despite lacking solid justification. On the other hand, it remained within the sideways channel on the hourly timeframe, where it has been trading for three weeks. As a result, while we saw a fairly good trend move on Monday, the overall technical picture remained unchanged.

Overall, the market continues to wait. And it's not waiting for important macroeconomic data at the end of the week — it's waiting for new actions from Donald Trump. We are almost sure that the U.S. labor market and unemployment reports, even if they trigger some reaction, won't affect the broader technical picture. The dollar simply refuses to strengthen, even when there are fundamental and macroeconomic grounds for it. And on Monday, there were no significant reports or speeches at all.

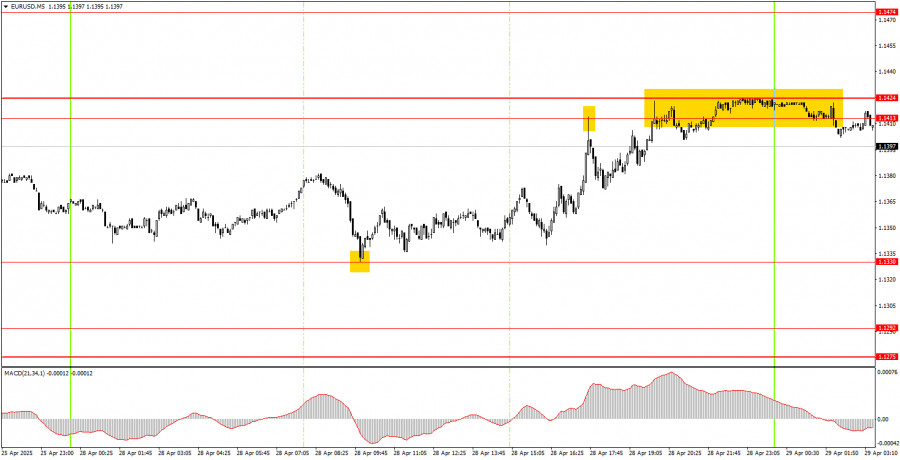

5M Chart of EUR/USD

At least one solid trading signal was formed on Monday in the 5-minute timeframe. During the European session, the price bounced off the 1.1330 level and, by the end of the day, had reached the nearest target—the 1.1413 level. Thus, novice traders could have opened long positions in the morning and closed them in the evening, resulting in a profit of about 60 pips. A rebound from the 1.1413 level could also have been traded, but the short position did not bring profit.

Trading Strategy for Tuesday:

The EUR/USD pair maintains a bullish tendency on the hourly timeframe. Last week started with a new surge, but by Tuesday, Trump had triggered a drop. If we ignore those sharp swings, the market has been flat for three weeks. Market sentiment remains extremely negative toward the U.S. dollar and all things American. However, if Trump moves toward de-escalation of the trade conflict — the very one he started — the dollar may improve its position. No one knows when that will happen or whether it will happen at all.

On Tuesday, the pair may move in either direction again, as market movements remain entirely dependent on Trump's statements and decisions. We believe the flat range will persist for a while.

In the 5-minute timeframe, consider the following levels: 1.0940–1.0952, 1.1011, 1.1091, 1.1132–1.1140, 1.1189–1.1191, 1.1275–1.1292, 1.1330, 1.1413–1.1424, 1.1474–1.1481, 1.1513, 1.1548, 1.1571, 1.1607–1.1622, 1.1666, 1.1689. No significant events are scheduled in the Eurozone for Tuesday. In the U.S., the JOLTS job openings report will be published. However, this single report is not considered significant enough to influence the market meaningfully, so the pair will unlikely exit the sideways channel today.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.