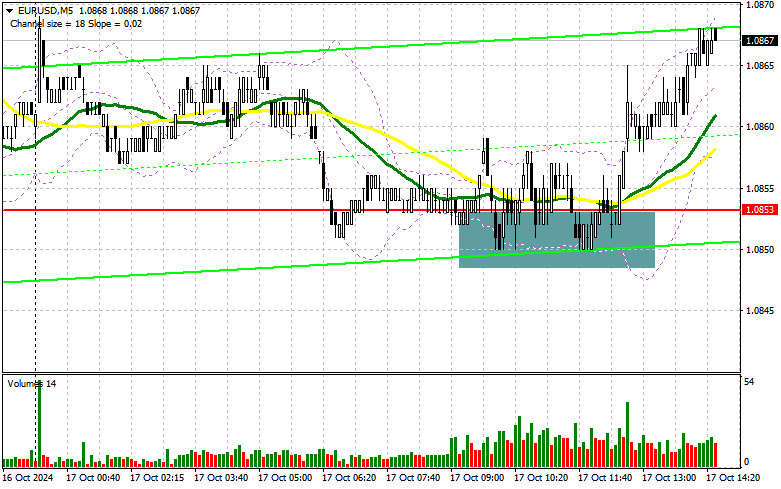

In my morning forecast, I focused on the 1.0853 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened. A decline followed by a false breakout around the 1.0853 level provided an excellent entry point for buying the euro, leading to a rise of just under 15 points. The low volatility ahead of the European Central Bank meeting is to be expected. The technical outlook remained unchanged for the second half of the day.

To Open Long Positions on EURUSD:

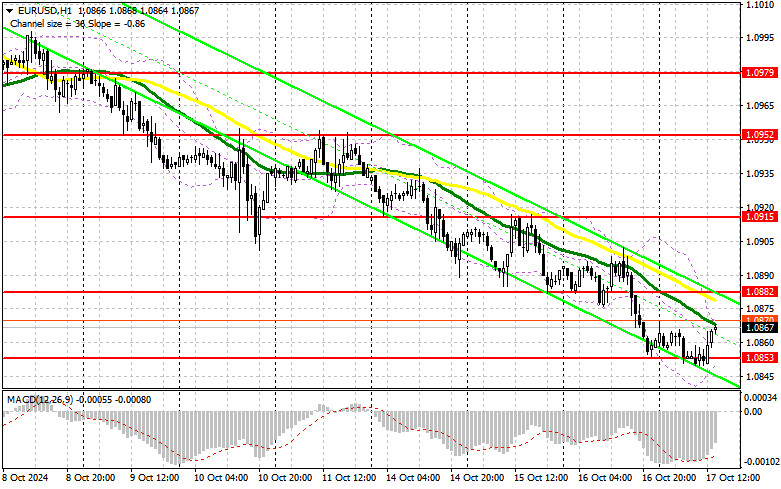

Given that the ECB meeting was extensively discussed in the morning review, repeating the information would be unnecessary. I have already outlined the appropriate actions and expectations. In the second half of the day, in addition to the ECB meeting, U.S. retail sales data, which has a strong influence on the currency market, will also be released. The figures for weekly initial jobless claims, the Philadelphia Fed manufacturing index, and industrial production changes are less significant. In the event of another decline in EUR/USD after Christine Lagarde's speech and strong U.S. statistics, only the formation of a false breakout around the support level of 1.0853—which performed well in the first half of the day—would provide a good condition for building long positions, opening the way to the 1.0882 level. A breakout and retest of this range will confirm the correct buying entry point, with the target of reaching 1.0915. The final target will be the 1.0952 high, where I will take profits. If EUR/USD declines further and there is no activity around 1.0853 in the second half of the day, the downward pressure on the euro will persist. In that case, I will wait for a false breakout around the next support at 1.0830 before entering long positions. I will consider buying EUR/USD on a rebound only from the 1.0808 minimum, aiming for an upward correction of 30-35 points within the day.

To Open Short Positions on EURUSD:

Despite a slight rise in the euro, sellers continue to hold control over the market. If the pair surges after significant events, only the formation of a false breakout around 1.0882—where the moving averages supporting the sellers are located—will offer a good entry point for opening new short positions, with a target of further decline to the support at 1.0853. A breakout and consolidation below this range (which has proven effective today), as well as a retest from the bottom up, will provide another good selling opportunity, targeting a move towards 1.0830, further reinforcing the bearish market. Only here do I expect more active buyers. The final target will be the 1.0808 level, where I will take profits. If EUR/USD rises in the second half of the day and there are no bears at 1.0882, which is only possible after cautious comments from Lagarde about rate cuts, buyers may have a chance for a correction. In this case, I will hold off on selling until testing the next resistance at 1.0915. I will also sell from this level but only after an unsuccessful consolidation. I plan to open short positions following a rebound from 1.0952, targeting a downward correction of 30-35 points.

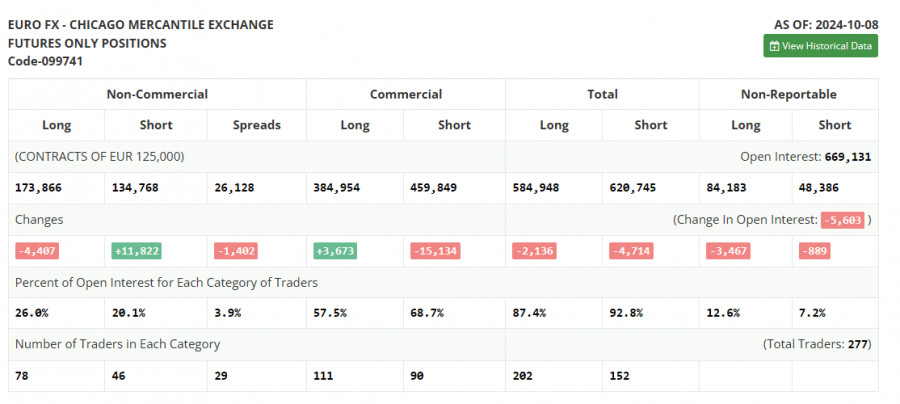

In the COT report (Commitment of Traders) for October 8, there was a sharp increase in short positions and a decrease in long positions. The report already accounts for the latest U.S. labor market data but not the inflation figures, which likely further increased short positions on the euro. For now, everything favors the U.S. dollar, and only good European statistics, which are expected in the near future, can stop the bearish market for this trading instrument. However, this does not cancel out the medium-term upward trend for the pair, and the lower it goes, the more attractive it becomes for buying. The COT report showed that long non-commercial positions decreased by 4,407 to 173,866, while short non-commercial positions increased by 11,822 to 134,768. As a result, the gap between long and short positions narrowed by 1,402.

Indicator Signals:

Moving Averages:

Trading is taking place around the 30 and 50-day moving averages, indicating market uncertainty.

Note: The period and prices of the moving averages are based on the author's H1 chart and differ from the classic daily moving averages on the D1 chart.

Bollinger Bands:In case of a decline, the lower boundary of the indicator around 1.0853 will serve as support.

Indicator Descriptions:

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. The 50-period MA is marked in yellow on the chart.

- Moving Average (MA): Determines the current trend by smoothing volatility and noise. The 30-period MA is marked in green on the chart.

- MACD (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

- Bollinger Bands: 20-period Bollinger Bands.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific criteria.

- Long non-commercial positions: The total long open position of non-commercial traders.

- Short non-commercial positions: The total short open position of non-commercial traders.

- Total non-commercial net position: The difference between short and long positions of non-commercial traders.